THE MANAGERGrowth Strategies

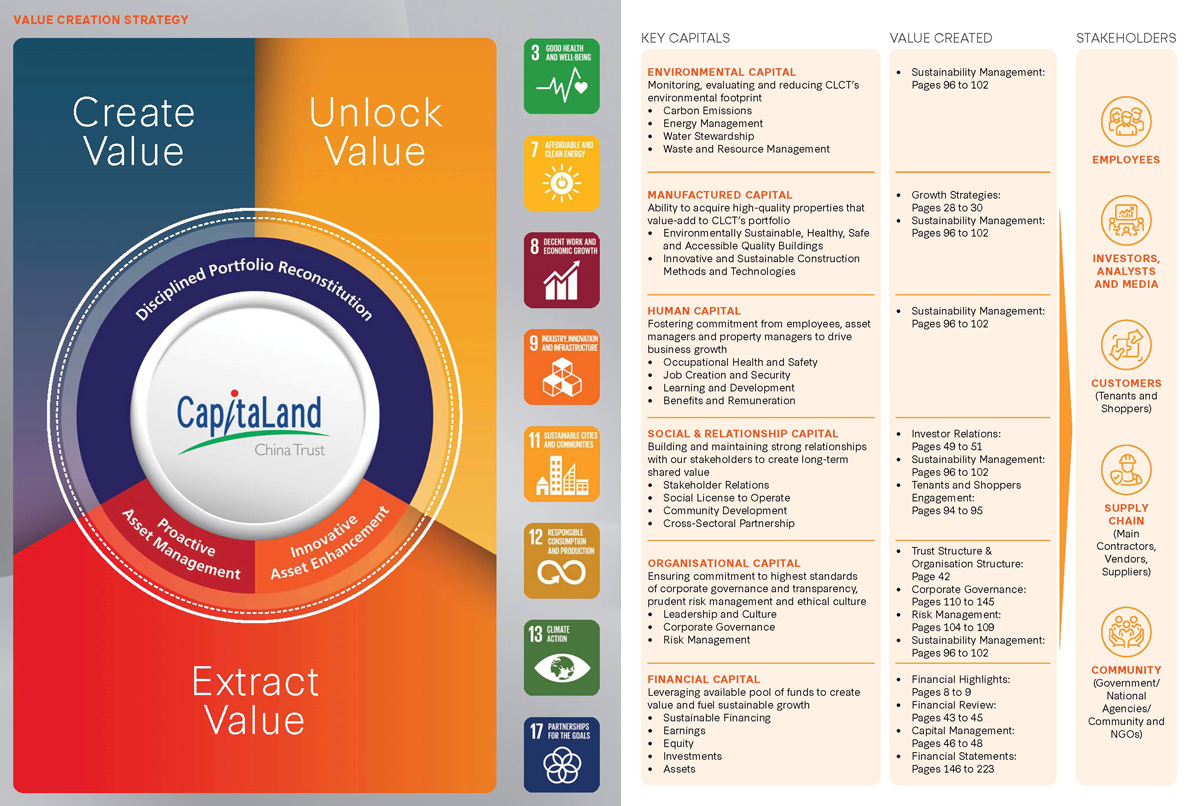

Our growth strategy is focused on three key pillars: Creating, Unlocking, and Extracting value. We meticulously cultivate our portfolio with a disciplined reconstitution strategy, ensuring a robust and forward-looking asset mix. Proactive asset management elevates the intrinsic value of our portfolio, drawing prominent tenants to our quality spaces that enhance their operational efficacy. This strategic positioning enables us to deliver sustainable returns to our Unitholders. Our strategy is reinforced by a prudent capital and risk management framework, underpinned by a commitment to sustainability.

Strategic advantages and growth potential are further realised by leveraging on CapitaLand Group’s extensive pipeline of high-quality assets as well as operational excellence through the wide-ranging real estate platform, strong local network, and professional property management capabilities. Together, these elements pave the way for our sustainable growth and market leadership.

Our objective is to achieve growth through strategic and well-timed acquisitions that align with our long-term goals. We focus on investing in assets with quality growth potential and synergistic value. To strengthen the resilience of our portfolio, we invest in a diversified portfolio of income-producing real estate across various asset classes.

We proactively source potential acquisitions from our sponsor's pipeline as well as third-party vendors with the aim of creating a future-ready portfolio that can deliver stable and sustainable distributions to our Unitholders.

We continuously review the performance of our assets and identify the optimal stage in their lifecycle to unlock value. By divesting non-core, mature assets, we will be able to optimise returns for our unitholders in the long term. This allows us to reallocate capital to more promising opportunities that offer higher potential for growth and value creation. We remain committed to evaluating our portfolio rigorously and taking decisive actions to unlock and deliver long-term value for our Unitholders.

PROACTIVE ASSET MANAGEMENT

Our priority is to achieve organic growth through customer-centric initiatives. This includes optimising tenant mix, implementing proactive leasing strategies, deepening tenant engagement, and leveraging CLI’s omni-channel platforms and loyalty programs. Our goal is to enhance tenant experiences and operational efficiency while managing costs effectively.

INNOVATIVE ASSET ENHANCEMENT

At opportune moments, we will embark on asset enhancement initiatives to reposition the properties and drive competitiveness to maximise asset value and better cater to the preferences of today’s customers.